Ah, credit scores! The mysterious three-digit numbers that determine whether we’re cool enough to handle credit cards or stuck in a financial “meh” zone. Fear not, my fellow credit crusaders, for this guide will take you on a journey through the wild world of credit scores. Buckle up and let’s better understand this perplexing financial puzzle!

In This Guide:

- Step 1: What the Heck is a Credit Score?

- Step 2: Cracking the Code: The Secret Ingredients

- Step 3: Why Should I Care About My Credit Score?

- Step 4: Unravel the Mystery: Check Your Credit Score

- Step 5: Upgrading Your Score: Unlock the Level-Up Cheats

Step 1: What the Heck is a Credit Score?

Imagine your credit score as the popularity ranking in high school, but instead of coolness, it measures your financial awesomeness. The scale goes from “I-can’t-afford-my-lunch” 300 to “I-own-a-private-island” 850. So, the higher, the more credit you can use. Now be warned, in laymen’s terms this means that the higher the score the more debt you can accumulate. A good score can actually get you into serious trouble if you are not careful.

Step 2: Cracking the Code: The Secret Ingredients

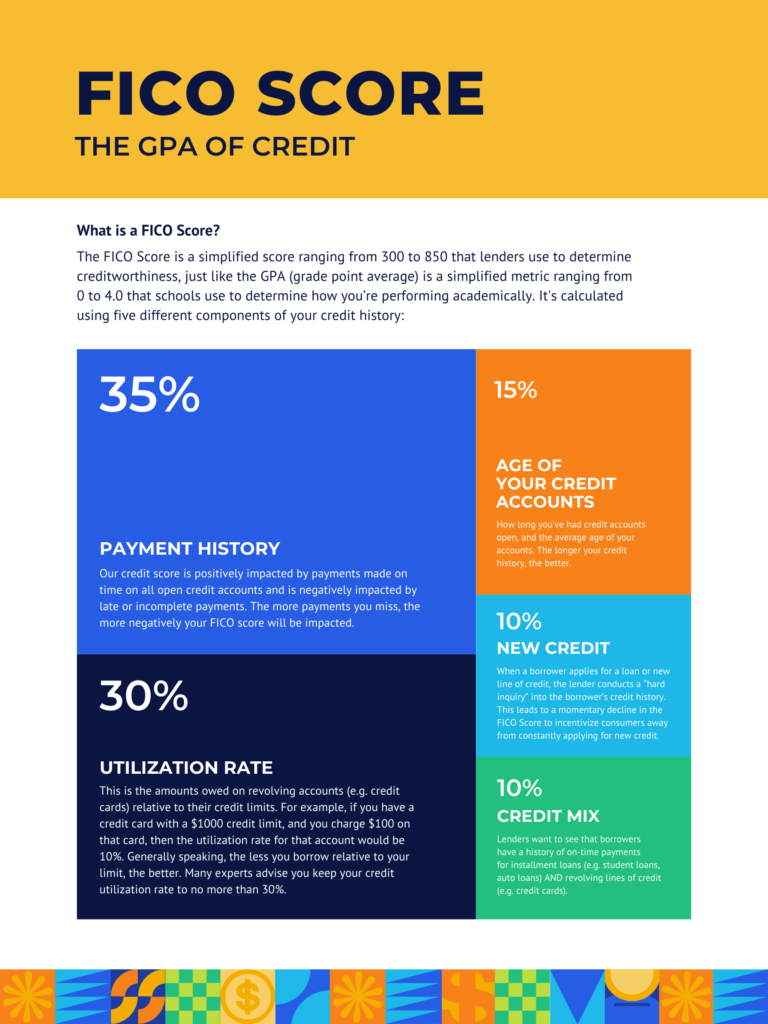

Your credit score is cooked up with a recipe of 5 main ingredients.

- Payment History (35%): It’s like getting graded for paying your debts on time. Show those creditors you’re no procrastinator!

- Credit Utilization (30%): Think of credit cards as pizza slices; the fewer slices you gobble, the happier your tummy (and your score).

- Length of Credit History (15%): It’s like aging fine wine. The longer you’ve been sipping credit, the tastier it looks to lenders.

- Credit Mix (10%): Diversify, baby! It’s like juggling balls; lenders love to see you handle credit cards, student loans, and maybe a mortgage (don’t drop those balls!).

- New Credit (10%): Here’s where you’re in a flirting game with credit. Opening too many accounts quickly sends vibes like “I’m desperate for attention!”

Here is a helpful infographic to keep all of these pieces of the credit score straight.

Step 3: Why Should I Care About My Credit Score?

Picture this: A good credit score is like a magical “Open Sesame” that grants access to fantastic financial opportunities (and also dangerous amounts of debt if you aren’t wise).

- Loan Approvals: With a sparkling score, you’ll charm lenders and get loans like a boss, with low-interest rates and the red-carpet treatment!

- Credit Card Applications: Kiss boring cards goodbye! With a high score, you’ll wield the power to choose those fancy, rewards-packed cards that make life sweet. But only get credit cards if you are using them for points and paying them off every month. If you can’t payoff your credit card each month, then you are living beyond your means!

- Renting a Home: Raise your credit score, and landlords will be fighting to have you as their tenant. It’s like winning a popularity contest for best tenant!

- Employment Opportunities: Who knew your credit score could get you a job? Some bosses check it to see if you’re financially responsible or a wild spender!

Step 4: Unravel the Mystery: Check Your Credit Score

Time to whip out your detective hat and spy on your credit score! Visit AnnualCreditReport.com for your free credit report, a treasure trove of financial insights. And hey, lots of websites and apps offer free credit score tracking too! One of my favorites is the app Credit Karma. I can get free updates on my credit report monthly, www.creditkarma.com/lp/free-credit-scores-4

Here is a helpful table showing the different credit scores, how they rank, and what percentage of people have the various scores:

| 800 – 850 | Excellent | 10% |

| 740 – 799 | Very good | 18% |

| 700 – 739 | Good | 30% |

| 660 – 699 | Fair | 20% |

| 620 – 659 | Poor | 12% |

| 300 – 619 | Bad | 10% |

Step 5: Upgrading Your Score: Unlock the Level-Up Cheats

So your credit score is a bit, well, not-so-fabulous? Don’t worry, my friend, I’ve got some wicked cheat codes to level up:

- Pay Bills on Time: Be the credit world’s time traveler – never be late!

- Reduce Credit Card Balances: Slim down that credit utilization and make those creditors go “wow!”

- Avoid Unnecessary Credit Accounts: Stop being a shopaholic for new credit; it’s like buying more stuff that you never use.

- Credit Mix Magic: Be the credit wizard and mix it up with different types of credit; lenders love a magical recipe that combines different credit “flavors.”

- Expose Errors: Dig into your credit report and unleash your Sherlock Holmes skills. Catch those sneaky errors that drag your score down!

Conclusion

Your credit score is an important part of your financial health. By understanding how it works and what factors can affect it, you can take steps to improve your score and get approved for the loans and credit cards you need.

Here are some additional resources that you may find helpful:

- Experian: https://www.experian.com/

- TransUnion: https://www.transunion.com/

- Equifax: https://www.equifax.com/

- MyFICO: https://www.myfico.com/

I hope this blog post has been helpful. If you have any questions, please feel free to drop a comment below!